Digital Colleague Joyce: VvAA’s Insurance Check-Up

VvAA serves as the voice and support for over 130,000 healthcare professionals. It offers advice and services to healthcare professionals and organizations to support primary business operations and mitigate associated risks, including providing insurance. To ensure that insurance policies remain appropriate for their clients’ situations and future aspirations, VvAA periodically conducts insurance check-ups. This presents a challenge: how can the insurer maintain dialogue with all its insurance clients?

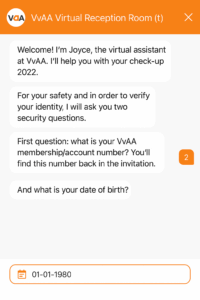

To address this, VvAA, in collaboration with Dialog Group, introduced Digital Colleague Joyce. Guy Polman, Service Desk Manager at VvAA, discusses the challenges, experiences, and successes of this chatbot.

Guy: “We have 130,000 members, many of whom are also clients. Some hadn’t been contacted since 2019. We wanted to engage with them to verify if their insurance policies still matched their situations. However, conducting phone consultations with all these clients in a short timeframe was neither operationally nor financially feasible.

So, we sought a sustainable and structural solution that would be applicable not only to the clients we hadn’t spoken to in a while but also be valuable in the future. After several brainstorming sessions, we arrived at a hybrid customer contact model.

With this hybrid model, we aim to periodically reach as many clients as possible, enabling them to make informed decisions about their insurance. On one hand, we have a team of advisors ready to assist clients with substantive advice. On the other hand, we employ chatbot technology and customer case management to automate part of the customer process and support our staff.

The final solution was developed with the help of Dialog Group, behavioral psychologists, conversation designers, advisors, Customer Care staff, and growth hackers. Through this collaboration, process bot Joyce came to life: a Digital Colleague.”

About Joyce, VvAA’s Digital Colleague

“Joyce is a process bot that discusses insurance products with clients. Over 40% of invited clients complete the conversation with Joyce in its entirety. This allows VvAA to provide valuable aftercare 24/7 without the traditional involvement of an advisor. By continually seeking smart applications in processing customer conversations, VvAA saves time. And because Joyce actively engages with clients on behalf of VvAA, advisors have more time for substantive conversations with clients who need them.”

Starting and Adjusting

Guy: “We started small in 2020, then gradually learned and further developed Joyce. We first deployed Joyce for aftercare on our personal liability insurance—a relatively simple insurance, making the customer journey an effective starting point. We initially invited seniors, assuming they would prefer speaking to an advisor. The opposite proved true. Seniors found the experience with Joyce pleasant and ultimately gave her the highest rating compared to other age groups.

Additionally, we noticed that our clients appreciate not being dependent on an advisor’s working hours. Some of our clients work night shifts, and among them, we see that they sometimes complete their insurance check-up at 2 a.m. Occasionally, they are called away for an emergency during the check-up, but Joyce is automatically paused so the client can resume later where they left off.”

Customer Feedback

“At the end of each insurance check-up, Joyce asks for feedback. We also conduct in-depth interviews with clients. This allows us to continually develop and adjust Joyce and quickly identify bottlenecks in the customer journey. We do this together with Dialog Group, behavioral psychologists, and conversation designers. We regularly sit down together to discuss where clients get stuck, where questions arise, whether the call-to-action needs adjustment, or perhaps the content of the text.

By now, we’ve formed a good understanding of how clients experience Joyce, as thousands of insurance check-ups have been completed. Our clients respond positively to Joyce, which is incredibly valuable for us and for the client. When clients go through an insurance check-up with Joyce, they make informed choices about their insurance and desired coverages, knowing what suits their situation. This ensures all our clients are appropriately insured. That’s our goal.”

Advisors Are Crucial

“We want to maintain periodic contact with all our clients, but for our advisors, that’s not feasible—even if we were to double their number. And the question is whether that’s necessary. Joyce, client feedback, and input from my colleagues have answered that question.

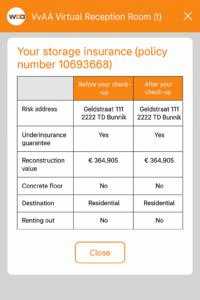

Our advisors now have extra time for valuable conversations, and soon they’ll be able to do so without having to go through all the client’s data before starting the advisory conversation. The advisor wants to ask meaningful questions: How have you arranged your pension? What are your housing plans for the coming years? What have you arranged in case of unexpected disability? What are your plans regarding your pension? That’s the difference between Joyce and an advisor. An advisor can connect the complexity of these questions and provide the right advice to the client, while Joyce excels at going through straightforward steps, such as checking certain coverages of a non-life insurance policy.

Dialog Group

Currently, we’re exploring how to present the information Joyce has gathered during a client conversation. The advisor can pick up where Joyce left off, the client gains good insight into their situation, and the conversation can proceed more efficiently and effectively.”

Guy Polman: “Because Joyce is so well-utilized by our clients, we can provide large groups of clients with the service they deserve. At the same time, our advisors have sufficient time to conduct substantive conversations with clients who need them.”

Enabling Digital Colleague Joyce to Communicate About More Complex Insurance

“Some insurance policies are more complex, and we’re experimenting with how to deploy Joyce for these. An example is the disability insurance (AOV). We realize it’s important for the client to understand the impact of certain changes on their financial situation. But the AOV and its specific coverage are complex matters that aren’t always immediately clear to clients. That’s why Dialog Group created videos explaining crucial aspects when going through the insurance with Joyce. The videos are an experiment to explain important aspects of making choices regarding the AOV in clear language. Unlike simpler insurances, Joyce asks a number of control questions to check whether it’s wise for the client to seek advice.”

How Does a Digital Colleague Become Successful?

“When deploying a chatbot like Joyce, an organization must carefully consider what’s needed. Where do you want to place control? With the client or the organization? We’ve chosen to keep it with ourselves. We do this by having Joyce ask very targeted questions so that all important questions are answered by the client, allowing us to provide good advice. That’s what makes it ultimately successful. A chatbot should never be an end in itself but a means that contributes to effective and efficient service. Don’t assume your bot is perfect from day one. You must remain curious, adjust, and always ask yourself: have I actually helped the client faster and better at the end of the process?”

A Digital Colleague makes direct customer contact manageable and can be scaled up or down according to your organization’s needs.

Could your organization use a Digital Colleague?

Then get in touch with Jan Verstegen, Managing Consultant to get a free demo.